Your Prop Firm: Unlocking the Potential of Proprietary Trading

In the ever-evolving world of finance, proprietary trading firms, commonly referred to as prop firms, have become a significant player. This article aims to dive deep into the intricacies of the proprietary trading landscape and why choosing your prop firm can be a game-changer for aspiring traders and seasoned professionals alike.

Understanding Proprietary Trading Firms

A proprietary trading firm utilizes its own capital to trade in the financial markets, rather than trading on behalf of clients. The essence of proprietary trading lies in the firm’s ability to leverage its own resources to maximize profits while managing risks effectively. Here's a breakdown of how prop firms operate:

- Capital Allocation: Prop firms provide traders with capital to trade. This enhances the ability to take larger positions in the market without risking personal funds.

- Profit Sharing: The profits generated from the trades are typically shared between the trader and the prop firm, creating a mutually beneficial arrangement.

- Risk Management: Prop firms implement robust risk management strategies to protect their capital and ensure sustainability in their trading operations.

The Advantages of Trading with Your Prop Firm

Partnering with your prop firm offers numerous advantages that can significantly impact your trading effectiveness and profitability:

1. Access to Capital

One of the most appealing benefits of trading with a proprietary trade firm is the access to substantial capital. This allows you to:

- Engage in larger trades, increasing potential gains.

- Diversify your trading strategies across various asset classes.

- Test new strategies without the fear of significant personal loss.

2. Intensive Training and Support

Your prop firm often provides comprehensive training programs for traders, empowering them with:

- Market analysis techniques.

- Advanced trading strategies.

- Access to professional mentorship from experienced traders.

3. Cutting-Edge Technology

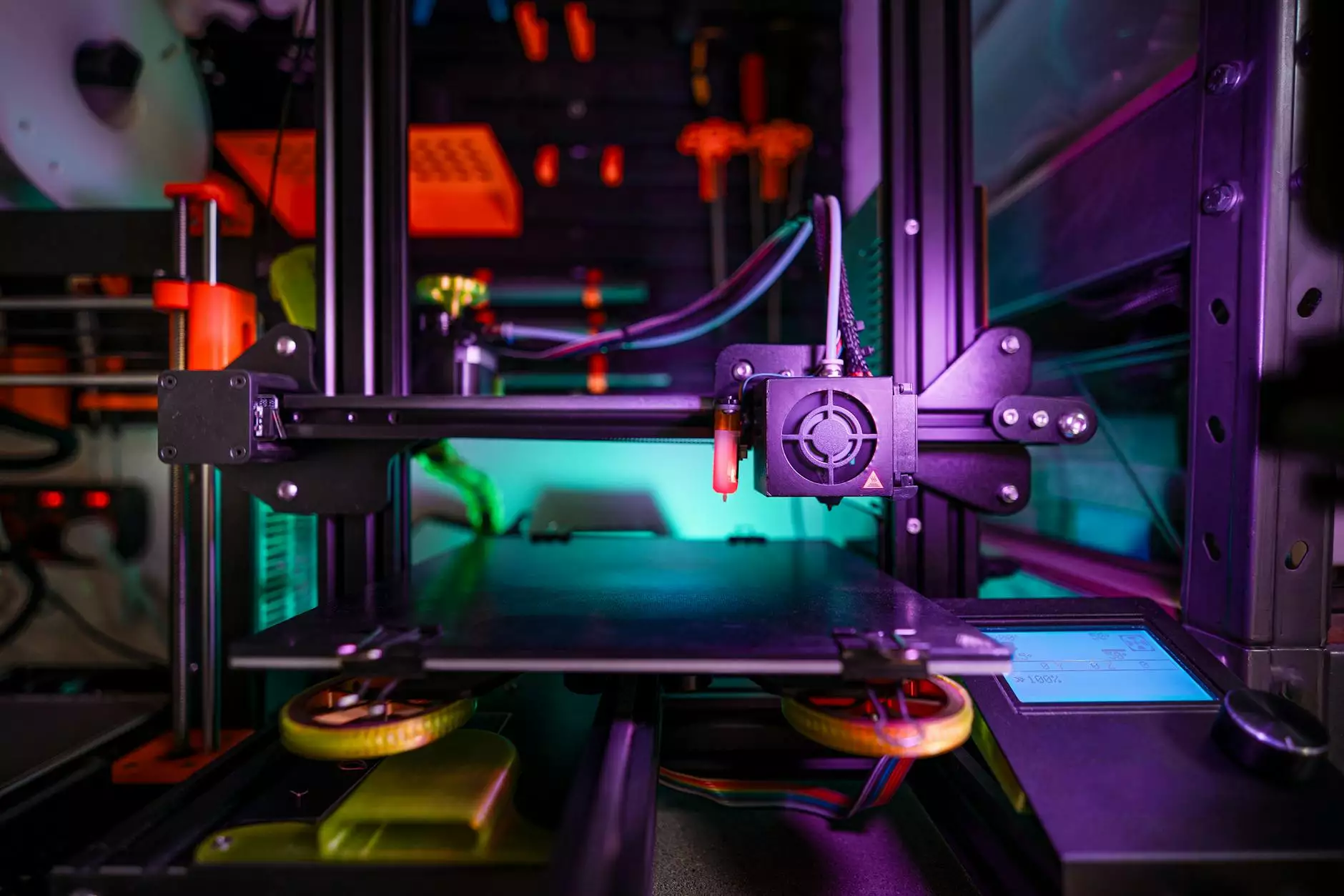

Proprietary trading firms invest heavily in technology, providing their traders with:

- Advanced trading platforms with sophisticated algorithms.

- Real-time data analytics tools for informed decision-making.

- Low-latency connections to exchanges for optimal trade execution.

4. Networking Opportunities

Being part of a prop firm opens doors to a network of like-minded traders and financial professionals. This community can offer:

- Collaborative trading opportunities.

- Shared insights and strategies.

- Potential career advancement in the finance sector.

Challenges of Proprietary Trading

While proprietary trading offers numerous benefits, it’s essential to acknowledge potential challenges as well:

1. Pressure to Perform

One of the significant downsides is the pressure to produce consistent profits. Traders may face:

- Increased stress levels due to high expectations.

- Developing anxiety related to trading performance.

2. Profit Sharing Structures

Understanding the profit-sharing structure is crucial. While it can be beneficial, it often means:

- Traders receive only a portion of their profits.

- Potentially complex agreements that may affect overall earnings.

3. Risk of Loss

Traders must also be aware of the risk of losses. Even with firm support, there are factors that can lead to:

- Substantial financial loss in volatile markets.

- Pushing traders towards overly aggressive strategies to recoup losses.

How to Choose Your Prop Firm

Choosing the right prop firm is vital for your trading career. Here are some criteria you should consider:

1. Reputation and Track Record

Research the reputation of your prop firm in the industry. Look for:

- Reviews from current and former traders.

- Evidence of consistent profitability and stability.

2. Offered Trading Strategies

Different prop firms specialize in various trading strategies. Ensure your firm aligns with your trading style:

- Equity trading.

- Forex trading.

- Options and derivatives.

3. Trading Environment

The trading environment, including tools and resources available, is crucial for success. Look for:

- Quality of trading software and technology.

- Availability of real-time data and research resources.

4. Terms and Conditions

Understand the terms of engagement with your firm. This includes:

- The profit-sharing ratio.

- Fees associated with trading, such as commissions and management fees.

Conclusion: The Future of Proprietary Trading

The future for your prop firm and the proprietary trading industry as a whole looks promising. As financial markets grow more complex, the demand for innovative trading strategies and expert analysis will only increase. By aligning with a reputable prop firm, traders can unlock their potential, leverage significant capital, and position themselves for sustained success in this dynamic field.

In summary, whether you are a budding trader seeking guidance or a seasoned professional looking for more opportunities, associating with the right prop firm can make a significant difference in your trading journey. Embrace the opportunities, overcome the challenges, and may your trading endeavors lead you to extraordinary success!